2020 began with hardly a cloud in the sky. It seems like a long time ago when we gave little thought to simple things like going to work or socializing with family and friends. Going or to our kids’ or grandkids’ soccer game or shopping were routine. We knew we faced a polarizing election, but at least voters would sort it out. Most everyone had a job and the U.S. unemployment rate was at 3.5%, a 50-year low. Investors were benefitting from the longest economic expansion and the longest bull market in history, Chinese trade-war tensions were subsiding, and the 2020 outlook was promising.

Then, the lights went out and 2020 became a year like no other. COVID-19 became the dominant theme of the year, and it impacted everything. It seemed like the word “Unprecedented” was used in every other sentence.

The Shutdown Caused Many Hardships: Life came to feel surreal as normal activities ground to a halt and the economy and most other activities shut down faster than at any time in history. Lockdowns, Stay-At-Home orders, Work-From-Home and social distancing meant that many social activities, businesses, schools and churches abruptly went dark. Parents were suddenly attending to school-aged children and helping with distance learning while dealing with a precarious work environment. Unexpected impacts included shortages of toilet paper, Clorox and baking flour. Bad haircuts and motion-sensing Purell dispensers became the norm. The NBA season and the NCAA basketball tournament were early casualties. Zoom became a staple of everyday life, and “You’re muted!” became an all-to-common refrain. Who knew Domino’s Pizza would displace a nice restaurant.

With no significant pandemic experience in over a century, it was naively assumed that it would be under control by summer. Obviously, COVID-19 virus proved more formidable and forced much unexpected change. Over 10 million were unemployed by the end of March. Oatmeal consumption jumped over 200%. Liquor sales spiked in 2020 as people used it as a way to cope with mental distress. COVID fatigue set in. Isolation took its toll. People died without the presence of family and friends. Little did we know that the U.S. would grieve the loss of over 340,000 deaths over the course of the year.

Uncounted small business owners lost their life work and many displaced workers lost jobs that would not return. The number of shooting victims in New York City more than doubled in 2020, with low-income and minority communities hardest hit. As if the COVID virus wasn’t enough, the May 25 killing of George Floyd thrust America into a soul-searching reckoning related to racial injustice. Although not caused by COVID, this tragic event caused social upheaval and a deep a psychic scar. Finally, the U.S. faced a polarizing election.

Gratitude for the Real Heroes: Despite the many hardships, there came to be a recognition and profound sense of gratitude for the real heroes. The healthcare and other essential workers cared for the virus victims and kept the country functioning.

-Health care workers demonstrated incredible dedicated service despite personal danger and sacrifice as they risked their lives to save others.

-Everyday workers delivered packages and stocked shelves.

-Medical supply people provided masks, car companies produced ventilators and Clorox disinfectant production was stepped up.

-Scientists and researchers raced against time to develop treatments and vaccines.

-And finally, there were uncounted and often un-noticed acts of helping and compassion by everyday people who helped meet needs wherever possible.

These examples showed courage and persistence in the face of adversity and long hours, and they are a true inspiration. The sacrifices add up to something much bigger than is readily evident and help to comprehend the meaning of who and what is really essential.

Charitable Contributions: Although charitable giving typically declines during economic crises, numerous reports show that people actually increased their giving.

Meals on Wheels, food banks and health-related charities saw increased giving during the pandemic, as Americans opened not only their hearts but also their checkbooks. There was also a big upward shift in indirect aid. As people became more aware of the needs in their community, there was help for vulnerable neighbors and support for local businesses through the downturn.

Expressions of Basic Humanity and the Human Spirit: A common refrain has been that we are all in this together. This hardship brought out many unique expressions of solidarity and resolve. A few examples:

-People across the country cheered healthcare workers and COVID-19 survivors.

-Parades of police and car caravans celebrated birthdays and other significant events.

-Minnesota landmarks were lit in purple to honor frontline workers battling the pandemic.

-Singing from balconies and other social distanced places battled the isolation: Boston residents belted out “Lean On Me” and Chicago metro area residents responded by singing the National Anthem and “We are the Champions.”

-These events went viral on social media and helped many others to cope.

COVID-19 tested us. We didn’t always act in the noblest ways. We’re all susceptible to COVID fatigue. There were certainly situations where social distancing was ignored and super spreader events caused more cases, hospitalizations and deaths. Nevertheless, we don’t want to forget the inspirational displays of goodness and basic humanity that helped lift us all up.

Vaccines-The Beginning of the end: The word “Unprecedented” certainly applies to COVID-19 vaccine development as drug companies created a vaccine against a novel pathogen within a year of its discovery, the fastest ever. The shortest timeline previously was for the Mumps vaccine, which took four years according to the Washington Post. Not everyone gets a chance to save the world, but dedicated individuals worked relentlessly to end this pernicious virus. The work by Pfizer, Moderna and many others represents a testament to scientific genius, the spirit of invention, persistence and a commitment to a higher cause. There is also a bright spot related to this research because the Messenger RNA used by Pfizer and Moderna may be used for future therapeutics to target other diseases, including cancer.

These vaccines are truly a game changer. We can only wonder what it would be like and how we would feel if these vaccines development time took two or three years.

Return to Normal?: As the COVID-19 ordeal ends there is a natural desire to return to normal. As the isolation gradually winds down, how quickly will people feel comfortable again seeing family and friends, taking vacations and going back to baseball and football games? The reality is that we aren’t going all the way back and some changes will be permanent. It has become a cliché to state that we have experienced 10 years of change in one year. But the pandemic has accelerated structural changes long in the making. Some businesses will not return and some jobs have been lost forever. There is deep uncertainty about how consumer and office-worker behavior might have changed. There is a huge hangover of debt. Education is likely to see many permanent changes. What will our churches be like, and who will come back? Adversity causes changes, and how will people react? COVID-19 forced us to be more resilient and self-reliant. As we think of the lessons learned and our reshaped priorities, hopefully the changes will help us be more aware, patient, deeper, compassionate and thankful.

MARKET REACTION, PERFORMANCE & OUTLOOK

Healthcare factors aren’t typically big market drivers, but COVID-19 dominated the markets in 2020. While 2020 was volatile, it is helpful to examine the year in a broader context. The graph below shows the longest bull market in history from March 2009 through February 2020. It also shows more protracted historic bear markets that often last far longer than the recent short downturn in 2020. Although accurate short-term projections are difficult, history gives a longer perspective and says it would not be prudent to extrapolate the recent market strength forward for the next ten years.

As shown below, investors benefitted from a record long 11-year bull market. This time period was accompanied by a record long 10 ½ year economic expansion. But both streaks ended in February as COVID-19 abruptly shut down the economy. Since there was no good pandemic precedent, the market panicked with the fastest decline in history into a bear market with waves of indiscriminate selling.

Both the Federal Reserve and Congress, benefitting from what was learned from the 2008/2009 Great Recession, reacted in record time with extraordinary monetary and fiscal stimulus. The market, recognizing this unprecedented stimulus, reacted with the fastest bull market recovery in history. The whiplash in the first half of 2020 produced the most extreme quarterly performance variance since the 1930s.

The table below provides additional perspective:

-2020 performance was generally well above historic norms.

-Volatility as measured by Standard Deviation was also high compared to the longer-term ten-year average.

-Small cap stocks and emerging markets are particularly volatile.

-Foreign developed and emerging markets stocks have been laggards over the last ten years.

-Long maturity U.S. Treasury bonds had extraordinary performance as interest rates declined and bond prices jumped upward (more below).

The observations from the table above provide context and perspective related to expectations for the future. One notable point is that recent performance is a poor forecast for the future. Listed below is additional information related to market expectations.

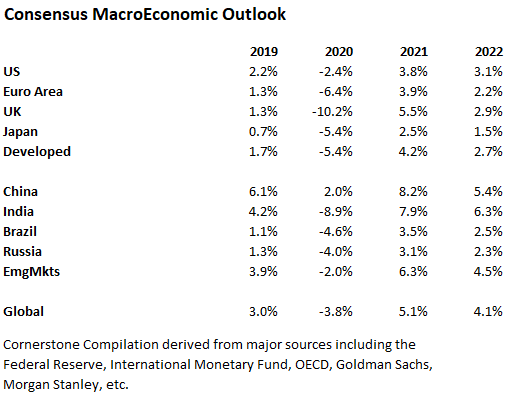

Consensus Economic Outlook:

There is a difference between the economy and the stock market, and the two do not move together in lockstep. Nevertheless, the economy is a major driver of corporate profits, and corporate profits are a clear driver of the stock market. The COVID-19 virus caused a global economic recession in 2020. China and Taiwan were the only major economies to achieve positive 2020 economic growth. The recession caused a significant reduction in 2020 corporate profits and contributed to the sharp market decline in March. Consensus expectations show a significant 2021 recovery and this should help increase corporate profits and help support the market.

There are a number of reasons to support the rationale for a strong 2021 economic recovery. The rapid development of vaccines gives relief to lockdowns and shutdowns and a resumption of more normal growth. There is also a fair amount of pent-up savings and demand, and consumers are likely itching to spend some of it. It is encouraging that forecasts are being revised upward, and these positive revisions are a positive indicator. It is noteworthy that many forecasts see a rising level of inflation. Inflation has been very low over the past decade, but massive government stimulus, improving economic growth and widening government budget deficits are reasons to push inflation higher. If inflation increases, it typically doesn’t hurt stocks too much unless inflation gets up to higher levels. Higher inflation will crush long-maturity bonds, however. While these forecasts focus on the vaccines and on hefty stimulus, domestic politics and geopolitical issues continue to be potential wildcard factors. It needs to be said that economic forecasts are subject to a wide range of outcomes.

Wall Street Targets:

Wall Street has long provided price and earnings targets for the upcoming year. History shows that these expectations may not be accurate, but they do show what is priced into the market. If there are no big surprises (like the 2020 coronavirus), then these targets provide perspective and can be helpful.

A summary of the top 14 Wall Street firms compiled by CNBC shows the following:

A few comments regarding these targets:

-Central bank stimulus and COVID-19 recovery are seen as major drivers.

-The recent uptick in mergers & acquisitions is seen as continuing in 2021.

-They all show the market moving up in 2021. When everyone sees upside, much of the optimism may already be priced in and the stage could be set for a decline.

-All show lofty Price/Earnings ratios that show valuation levels well above historic levels.

Valuation:

Equity markets are expensive by most valuation metrics. The S&P 500 consensus Price/Earnings ratio for the next/forward twelve months is a common valuation measure and is listed below:

At a cursory level, it looks like the market is nearly as expensive as the late 90s internet frenzy, and you have to wonder if we are “Partying like its 1999.” Many remember how that ended. There are a couple of major differences, however, between 1999 and 2020. The 10-year U.S. Treasury bond yield was over 6% in 1999, and now it is at 0.9%. In addition, many technology companies in 1999 were young and had minimal earnings, and today’s leaders have dominant business models. (Like Microsoft, Google, Amazon, etc.)

Although valuation levels aren’t quite as stretched as in late 1999, it is still sobering to remember that the tech-heavy Nasdaq fell 78% from March 2000 to October 2002.

Market bulls acknowledge high current valuation multiples, but see equities delivering decent relative returns versus even more expensive bonds. They believe that markets look less expensive when juxtaposed on a relative basis against current low interest rates and a low inflation environment. While conceding high valuation levels, they believe equities will grow quickly and catch up to their high valuation levels.

Market bears point to the extraordinary monetary accommodation around the world driven by central bankers dealing with the virus-induced slowdown. This stimulus has made all assets expensive, and results in low forward returns for both stocks and bonds.

It seems clear that the market has pulled forward some post-vaccine economic growth into current valuations and it will take time for the U.S. to grow its way into these valuation levels. Central bank monetary stimulus has also made all assets expensive as nearly-free money distorts valuation levels. It also seems reasonable that when equities are adjusted for low interest rates, valuations aren’t quite as extreme. This is especially true given the fact that U.S. Treasury bondholders are currently receiving negative inflation-adjusted real rates of return due to low nominal interest rates.

History shows that Valuation levels are not a good predictor of short-term returns, but they are a good predictor of longer-term returns. Consequently, the current high valuation levels could persist for some time. There are market pundits predicting both an imminent bear market and a sustained bull market, but it would be a fool’s errand to confidently predict either. Regardless, current valuation levels and low interest rates point to below-trend investment returns on a longer-term basis. While returns for stocks could be lower over the next decade, they should still perform better than longer-maturity bonds.

What To Do Now:

The markets have generated big returns in 2020, and also since 2009, and it is easy to be lulled into a false sense of overconfidence. The big gains by year-end 2020 help us forget the precipitous decline in March. But markets run on fear and greed and the euphoric emotion can plummet once again into volatile, undisciplined selling. Here are some factors to consider:

-Don’t let big up or down market moves change your investment objective. Big upside market moves make us forget the pain of down markets and to overestimate our tolerance for downside risk. This could cause additional buying of an expensive market. Similarly, big down markets cause us to abandon all hope and to get too conservative and to sell at the bottom.

-Rebalance. At a high level, rebalancing involves trimming the weights of the biggest gainers (because they have grown too big compared to your strategic weight) and buying the laggards (which have become underweight). To take an extreme example, if you own Tesla-TSLA (up over 700% in 2020), then the stock and the large growth asset class are too big and should be trimmed back. The cash proceeds from the sale should be put into the cheaper underweight assets. If you are a self-directed Do-It-Yourself (DIY) investor, then you need to rebalance your portfolio. If you have an adviser, then ask them about rebalancing.

-From a tactical standpoint, Small Cap stocks and Emerging Markets have trailed in recent years and look most attractive.

-Avoid FOMO (the fear of missing out). Do your own thinking. (See below)

-Stocks that are up the most are excellent candidates for charitable giving. This is a way to help achieve a rebalanced portfolio. A key Cornerstone objective is to encourage charitable giving. See Charitable Contributions

-Avoid long-maturity bonds. If inflation heats up, these bonds will perform badly.

-Don’t make plans for 10% future equity returns. Current high valuation levels indicate that 6% equity returns are more reasonable for financial planning and retirement expectations.

More Detail and Red flags Below:

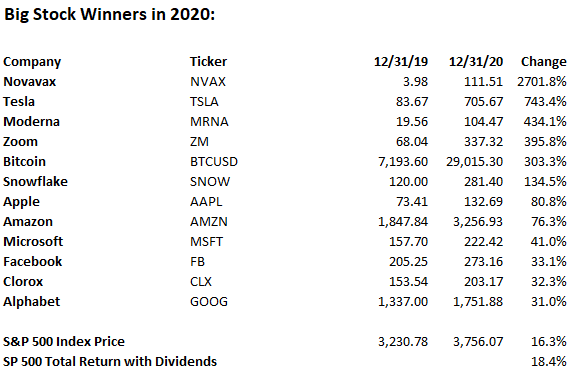

BIG STOCK GAINS IN 2020:

Investors should utilize funds unless there is sufficient time and experience to research individual securities. Even then, most investors would achieve greater returns with an index fund than picking stocks. Nevertheless, it is interesting to review some high performing and high-profile stocks as listed below:

(Sorted by 2020 returns)

Some Comments:

-The big winner was Novavax, a biotech company trading on Nasdaq that is in late-stage trials with a COVID-19 vaccine. If the vaccine gets approved, the price will be justified. Otherwise, it might return to single digits.

– Tesla is noteworthy. Tesla is the sixth-largest company in the S&P 500 but it is not profitable without regulatory emissions credits. Tesla’s market value is currently 2 times the combined value of Ford, GM and Toyota. Elon Musk is a true visionary, but the valuation looks very stretched.

-Moderna is up based on their successful COVID-19 vaccine. Few knew of Zoom before the pandemic hit, but Zoom kept us going through all the isolation.

-The S&P 500 market value is dominated by five big tech stocks: Alphabet/Google, Amazon, Apple, Facebook and Microsoft. These five stocks have significantly outperformed in the past. You might characterize the S&P 500 as the Big 5 and the little 495. The Big 5 outperformance may continue for a while but it is not likely to persist in the longer term. A diversified portfolio has stood the test of time, and an overconcentration in these stocks poses longer-term performance risks.

It may be tempting to invest in a few potential high-flyers to boost your retirement account. For example, if you bought $1,000 worth of Amazon when it came public in May 1997, it would have grown to $2,175,000 by year-end 2020. What’s not to like? For every Amazon, however, there are hundreds of losers like Pets.com and TheGlobe.com. TheGlobe.com had the distinction of spiking over 10x during its first day of trading, but its business model is long gone.

The reality is that it is difficult to find many of the big winners before they make their big moves. Most of the big 2020 stocks benefitted from COVID-19, and no one saw the virus risk at the beginning of the year. At this point it is difficult to identify the 2021 market drivers.

Small Cap Stocks:

Small cap stocks have outperformed large cap stocks historically, although they have been laggards over the last 10 years. Small caps as measured by the Russell 2000 index trailed large caps in 2020 until the fourth quarter.

Although small caps are more volatile, they are important in a portfolio’s overall asset allocation plan. Small caps are expected to offer significant forward growth because their greater operating leverage allows profits to grow faster in an expanding economy. Small caps have been under-owned and should benefit from increased investor interest.

Foreign Stocks:

International stocks outperformed in the 1970s, 1980s, and the 2000s, but have trailed the S&P 500 since the 2008/2009 Great Recession. International stocks are cheaper than U.S. stocks, and especially U.S. large cap growth stocks, and should benefit from investors seeking cheaper valuation levels.

Emerging Market Stocks:

Emerging Mkts: Emerging market stocks are another asset class that has trailed in recent years, but has provided a nice rebound in Q4. Emerging market stocks are more volatile but offer better growth prospects than developed markets based on a younger population and a growing middle class. China is a large component of emerging markets and it offers significant growth potential. Emerging markets benefit from a weaker dollar, they are cheaper than developed markets, they offer diversification benefits and they look poised for good longer-term performance.

Historic Interest Rates:

Interest rates have been trending lower since the early 1980s. The 10-year U.S. Treasury bond interest rate peaked at 15.82% in September 1981 as the U.S. battled double-digit inflation. As inflation subsided, rates have trended lower. Interestingly, forecasters, including the US Federal Reserve, have consistently projected rising rates. Historic long-term bond total return performance has been high due to bond price increases as rates declined. With interest rates at current low levels, there is little potential for additional bond price gains. Instead, any increase in yields will negatively impact bond prices and will be a drag on total return performance. If inflation picks up faster than expected, then longer-maturity bonds will experience significant negative performance.

Interest Rates in 2020:

The 10-year US Treasury bond began 2020 with a 1.92% yield. As the COVID-19 pandemic spooked markets, the 10-year treasury yield briefly plunged below 0.5%, on March 9 due to recession fears. The yield then spiked upward based on a safe haven flight-to-quality trade. As vaccines allow for increased economic activity, rates have risen to 0.92% at yearend. At this time, real yields (nominal yield net inflation) are negative. Fed policy is to keep short-term rates like 90-day Treasury Bills pinned near zero through 2023. With this low interest rate backdrop, short bonds will earn very little return and longer maturity bonds may have negative returns as interest rates eventually normalize and bond prices decline.

Historic US Dollar:

The U.S. dollar peaked after Fed Chair Paul Volcker and President Reagan broke the back of double-digit inflation with high interest rates in the early 1980s. The dollar rose again between 1997 and 2002 as Germany assumed high costs of reunifications with East Germany and as Europe implemented austerity plans and increased taxes.

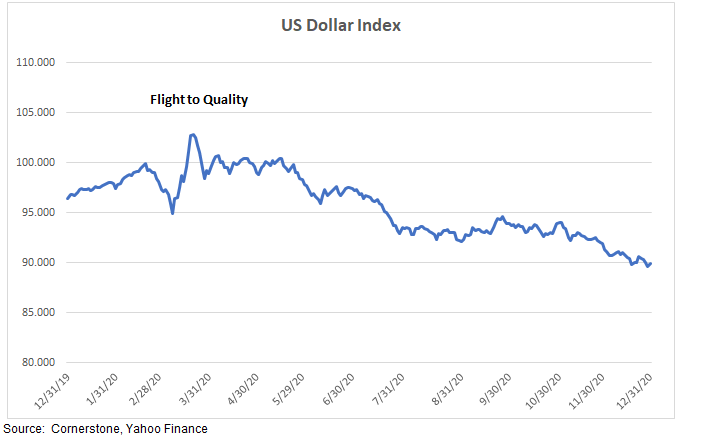

US Dollar in 2020:

The dollar was trending up in early 2020 until markets panicked and interest rates fell over recession fears from the pandemic. The dollar then blipped up in late March as traders pursued a safe haven flight-to-quality trade. More recently the huge monetary and fiscal stimulus and the prospect of federal budget deficits have been factors causing the dollar to fall. The Federal Reserve’s policy to keep short-term interest rates near zero until 2023 is also pressuring the dollar lower.

RED FLAGS:

The 2020 market produced great returns but trees don’t grow to the sky. There are notable “Red Flags” that warrant scrutiny and consideration.

–Fed Put. The Fed “Put” is seen as a Backstop: the so-called Fed “Put” continues to provide investor support based on the widespread belief that the Federal Reserve will move aggressively to prevent or at least mitigate any deep market swoons. Although there is no actual Fed Put trade, (Put Option trades offset market downside risk), Fed actions are seen as providing “Put-Like” protection against severe market declines. In any event, the Fed Put narrative encourages risk taking without having the actual wherewithal to prevent a severe market decline.

–FOMO: The recent market strength has surprised many institutional investors, and there does appear to be an element of FOMO-the Fear Of Missing Out. Markets trade on fear and greed, and the current market strength appears to have a significant amount of momentum-based trading. The current greed factor can be reversed quickly, as was seen this past March.

–IPOs-Initial Public Offerings: U.S. Initial Public Offerings (including Special Purpose Acquisition Corporations) raised a record $167 billion in the U.S. during 2020, compared with the previous record of $108 billion during the 1999 dot-com boom, according to Dealogic. These deals have jumped roughly 18% on their first day of trading, and there is a concern that the market is getting too frothy.

Margin Debt and Options Contracts-Investors borrowed a record $722 billion in margin debt against their investment portfolios through November according to the Financial Industry Regulatory Authority. High margin debt levels preceded market peaks in 2000 and 2008. Option contract volume has also been at record levels. Call option contracts and other derivative strategies can be very lucrative in bull markets, but can be disastrous in sharp market declines.

New Retail Investors and Robinhood: Market observers point to increased retail investment activity by newer and less experienced investors. The Robinhood trading platform grew rapidly by offering zero commission trades and an appealing user interface. Charles Schwab, Fidelity and others quickly matched Robinhood’s zero commission trades. With big 2020 gains, investing has been eurphoric, just as it was for day traders in 1999. No one knows where markets are headed on a short-term basis, but the Robinhood phenomenon is a clear red flag.

The Red Flags listed above are not a call to sell all and go to cash. Time in the market is more important than timing the market. But the analysis points to a disciplined approach to rebalancing and tactical adjustments away from high-flyers and towards under-owned and cheaper asset classes like small caps and emerging markets. It is also a cautionary warning against the long-maturity bonds.

Wrapping Up:

2020 was a year like no other. The word “Unprecedented” was used often because it is hard to find another word to better describe the year.

To recount a few examples:

-Deaths, ICU units at capacity, temporary hospitals in parking lots.

-Health care and essential workers pushed to the limit.

-Record short vaccine timeline development.

-Charitable giving and acts of compassion.

-Numerous investment and economic records for depths, heights and speed.

Looking to 2021:

Thanks to vaccines we can look forward to a better year as we can re-connect with family, friends and work associates.

The markets are less predictable but we can say a few things:

-Last year’s gains were surprising, and the future will bring more surprises, both good and bad.

-Last year ended up being a good year in the market but it is important to never confuse a bull market with brilliance.

-Markets are noted for teaching great humility and that definitely applies to this analysis. The commentary is intended to provide educational perspective, but only time will tell what the future actually brings.

-No one knows exactly when the music stops, but a proactive, disciplined approach is essential to providing good long-term returns.

Goodbye 2020 and all the best to 2021!

Jeff Johnson, CFA

January 4, 2021

For additional investment and financial planning information See Cornerstone Investments