The table above shows the strength of the U.S. stock market, and especially the large-cap S&P 500 Index. Despite weakening global economic growth and continuing trade war fears, U.S. and foreign equity markets are up double digits so far in 2019. Fixed income performance has also been strong based on falling interest rates and corresponding bond price increases.

The U.S. stock market set an all-time record last September, then it panicked on fears of an imminent global recession, and now it is at a new all-time high. This volatility shows the market’s animal spirits working in both directions. At this point, the gains are based on expectations for lower interest rates and trade talk progress with China.

The U.S. stock market set an all-time record last September, then it panicked on fears of an imminent global recession, and now it is at a new all-time high. This volatility shows the market’s animal spirits working in both directions. At this point, the gains are based on expectations for lower interest rates and trade talk progress with China.

President Trump continues to criticize Fed Chair Jerome Powell, but Powell recently said the central bank is “insulated from short-term political pressures”. Regardless, the Federal Reserve looks certain to cut the Fed Funds rate by 0.25% in their July 31 Fed Open Market Committee meeting. Second quarter earnings reports will also help determine second half performance. It is interesting to note that strong earnings growth in 2018 and 2019 has helped keep the market valuation at moderate levels. The current 16.7 forward Price/Earnings valuation is in line with the 16.6 average PE for low inflation (range of 0-2%) time periods since 1950.

Beyond Meat-BYND was a notable IPO. The company sells plant-based burgers and is up over 360% since its May 2 opening price. This is an interesting business model, but it also shows a fair amount of investor euphoria.

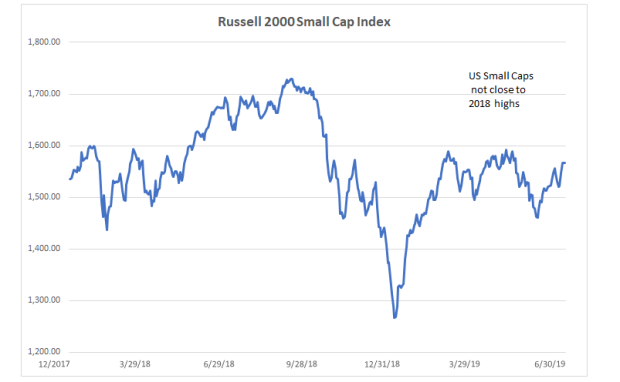

The Russell 2000 Small Cap Index is nowhere near the 2018 highs but it is still up 17% YTD. The small caps haven’t rebounded like US large caps. On a longer-term five-year basis, small cap stocks have trailed the large cap S&P 500 by nearly 4% annualized. This under-performance is likely to be reversed in the future.

Trade and central bank monetary policy continue to be critical to the outlook for global stocks. A comprehensive trade deal between the U.S. and China is unlikely in the near-term, notwithstanding the June 29 “truce” between Presidents Trump and Xi Jinping. The hope is that there will be a resumption of serious negotiations between the two sides. The European Central Bank recently indicated that the ECB will consider monetary easing. In the UK, economic growth continues to lag due to Brexit uncertainty. For example, the June Manufacturing Purchasing Managers Index came in at 48.0, down from 49.4 in May. This is the lowest level since February 2013.

Emerging markets led all major markets in 2017 with a 37.3% gain but they fell 14.6% in 2018. Emerging markets are up a respectable 10.6% so far in 2019. Emerging markets are very cheap and will be a big beneficiary as the US reduces interest rates.

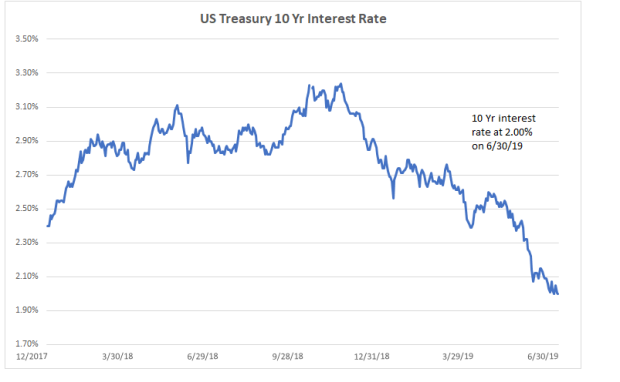

The 10-year US Treasury interest rate closed at 2.00% on 6/30/19. Interest rates for longer maturity bonds have been relatively volatile in recent years. For example, the 10-year US Treasury recorded an all-time low of 1.36% on July 8, 2016. Then it moved up to a 3.23% closing yield on October 8, 2018. Since then, the 10-year interest rate has trended downward again. Although longer-maturity interest rates may move up modestly, muted expectations for economic growth means that the phrase “lower for longer” looks appropriate.

The strong high-yield bond performance, so-called junk bonds, is largely the result of less fears of an imminent recession and the corresponding bond defaults.

What To Do Now:

It is nearly impossible to consistently call short-term market moves, regardless of whether you are a big-money institutional investor, a CNBC talking head, or an individual investor. It is more important to ignore the daily “Breaking News” and maintain your focus on your long-term Investment Objectives.

The large market moves, however, do require the disciplined practice of rebalancing your portfolio. With US stocks leading the market, it is an opportune time to take your US equity holdings down to 70% of total equity holdings. US large cap stocks in particular should be rebalanced into foreign developed and emerging markets. Your overall equity weight is also likely above your investment objective and this necessitates moving holdings into fixed income and cash.

The current market strength provides an excellent time to make charitable stock gifts. If you are retired, this is also a great time to refill your cash bucket.

This is clearly not a time to abandon your Investment Objective. If you have an investment adviser, then find out your portfolios’s asset allocation compared to your Investment Objective. If you don’t have an adviser, then you need to determine your current asset allocation. See DIY Regardless, you need to prune any high-cost funds in favor of low-cost index mutual funds and ETFs.

Remember, high market levels promote euphoria, or at least complacency and these higher levels usually have more downside risk than negative markets.

Jeff Johnson, CFA

July 13, 2019